Sprint: Big Presence

Big service and big savings. Now you can have both.

DISCIPLINES

Brand Development, Digital & Broadcast Production, Digital Marketing, Media Planning/Buying, Research, Social Media, Strategic Planning

CATEGORIES

Challenge

Shentel, the 6th largest communications technology company in the United States operates the Sprint wireless business in parts of Maryland, Virginia, Ohio, Pennsylvania and all of West Virginia and today serves over 4 million subscriber devices.

When Shentel-Sprint acquired regional competitor nTelos wireless it gave them the opportunity to convert almost one million former nTelos subscribers to Sprint service. In addition, they developed aggressive goals to add new Sprint subscribers in its newly created geographic footprint, which expanded to Southwestern Virginia (all points west of Richmond) and all of West Virginia, in just over one year.

There were many hurdles to overcome:

- Sprint suffered from a poor reputation in the new geographies

- nTelos customers and employees had been very loyal to the nTelos brand

- Verizon, AT&T and T-Mobile spent significantly more in media than Sprint

- Sprint’s national advertising focused on parity, actually less than parity, with its slogan “All networks are within 1% reliability”

- Sprint needed to retain nTelos customers and add new subscribers while investing $400 million to upgrade hundreds of its cellular towers and network to improve coverage in the area

Research

Research helped GKV develop overall strategies to meet the many obstacles facing Sprint.

- Internal employee research found a lack of confidence in Sprint among some former nTelos employees (now Sprint employees) at the store level.

- Attitudinal research conducted among 3,000 wireless customers in market confirmed:

- Consumers were dissatisfied with the wireless plan choices available to them

- Sprint had the poorest reputation compared to all other carriers in the territory

- The market was underserved by major corporations that ignored the region

- Residents had a high level of pride in their home turf

- Net Promoter Score (NPS) research indicated that Sprint’s NPS score in the new territory was below the national average for Sprint. Sprint’s NPS was significantly higher in every market operated by Shentel/marketed to by GKV than the Sprint NPS national average.

- Messaging research determined the key elements to trigger a consumer to switch were:

- Upgraded network/better coverage

- Unlimited data (Sprint was the original Unlimited carrier)

- Value (defined as best network for the lowest cost)

- Big data audience research culled from internal customer records and geo-cluster analyses determined that the most likely prospects to switch to Sprint were: young professionals/singles (Adults 25-34), growing families (Adults 25-44) including Latino families and multi-generational households, and Empty Nesters (Adults 55-64).

Challenger Brand Solution

Brand Inside

Educate the internal audience on the hundreds of millions of dollars Sprint was investing in VA and WV to improve wireless service and become the #1 carrier in the area.

Tactics:

- A team of agency personnel joined the Sprint team on a “big” marketing road show to explain the strategy, show the new communications materials, answer questions and rally the troops.

- One key message delivered to employees in the marketing road shows was that Sprint was about to spend the most advertising money, in its entire history, in Virginia and West Virginia, which was music to the sales staff ’s ears.

- The final launch event was to bring Sprint spokesperson Paul Macerelli (the former Verizon guy – now the Sprint guy), who had obtained some celebrity status, into the market to meet local employees. Paul was not used in broadcast communications since the Shentel- Sprint VA and WV networks were superior to the competition as a result of the upgrades. This would have been a conflicting message to the corporate “all networks within 1%” message Paul was delivering nationally.

Challenger Brand Solution

Symbols of Re‑Evaluation

Convert nTelos customers to Sprint customers before they leave for another carrier by demonstrating the benefits of an improved Sprint network.

Tactics:

- Communicate with former nTelos customers early and often about the coming benefits of the soon to be improved Sprint with direct messages such as text messaging, eblasts, bill stuffers and in-store materials

- Offer Sprint wireless plans that were comparable if not better than their current nTelos plan

- Ramp up urgency as conversion deadlines got closer

- Drive customers to Sprint stores to talk with store associates and experience their passion for the brand and the improvements in process

Challenger Brand Solution

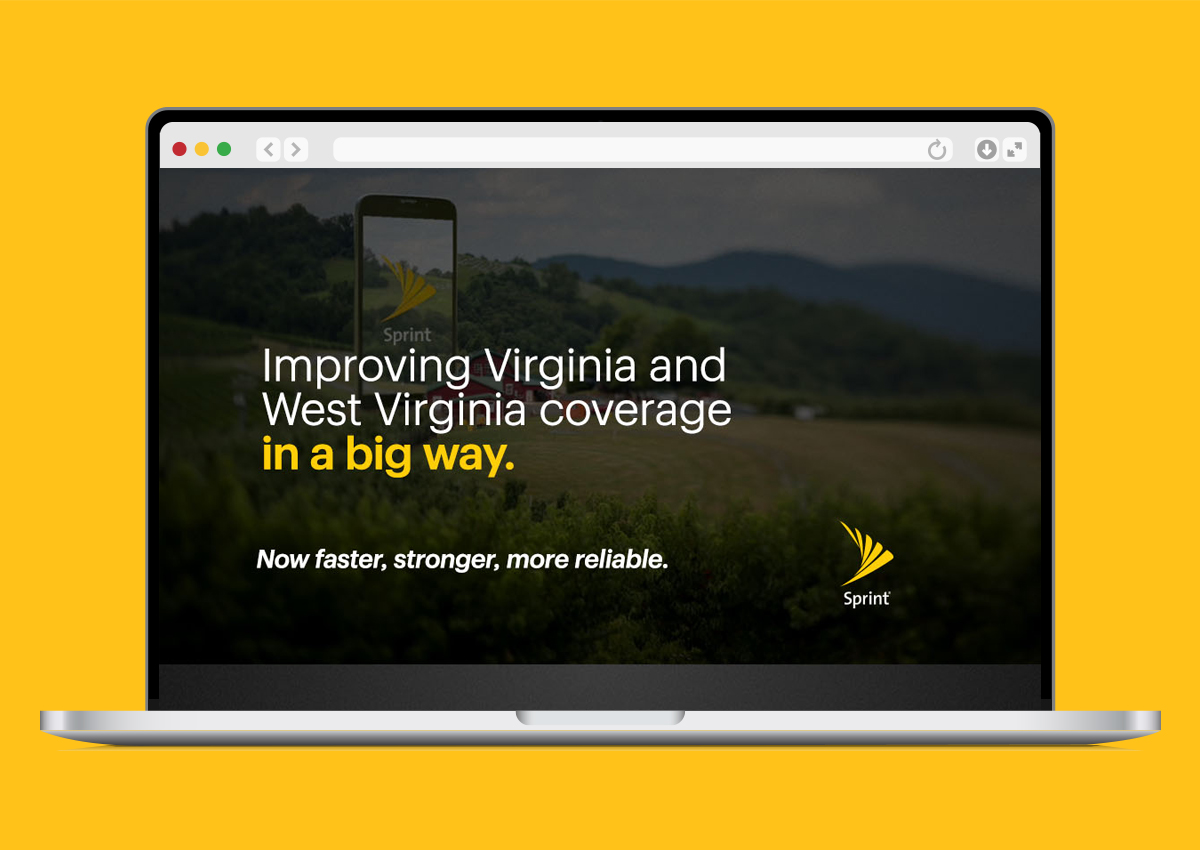

Emotional Connection

Create advertising that taps into local pride and tells the story of infrastructure improvements that will change the face of wireless in VA and WV.

Tactics:

- Develop separate communications for the Virginia and West Virginia markets and further, where possible, present even more localized messaging. Connect the national brand with the local markets to show that Sprint cares about the small communities and invests in them.

- Incorporate key consumer switch triggers such as improved network, unlimited plans and overall value under the investment umbrella.

- Create marketing materials that feel big and important in scope without spending major production dollars.

- Be patient with launch strategy. It was tempting to start heavy advertising the moment the acquisition was finalized. However, this would have backfired, as customers could have highly negative experiences with Sprint and this would worsen their perception of Sprint right out of the gate. On the other hand, waiting too long would mean jeopardizing sales goals. The team worked together closely with engineering to determine the optimal tipping point, when enough upgrades had been made for customers to notice a difference and while substantial work was ongoing (often complicated by local regulatory restrictions).

Brand Positioning / Creative Concepts

Sprint – The Best Value in Wireless Now Has The Best Network in Your Area

The campaign was called “Big Presence,” which literally meant that Sprint now had a much bigger presence in the markets they acquired and was making major investments in those markets to upgrade wireless service and improve overall wireless experience.

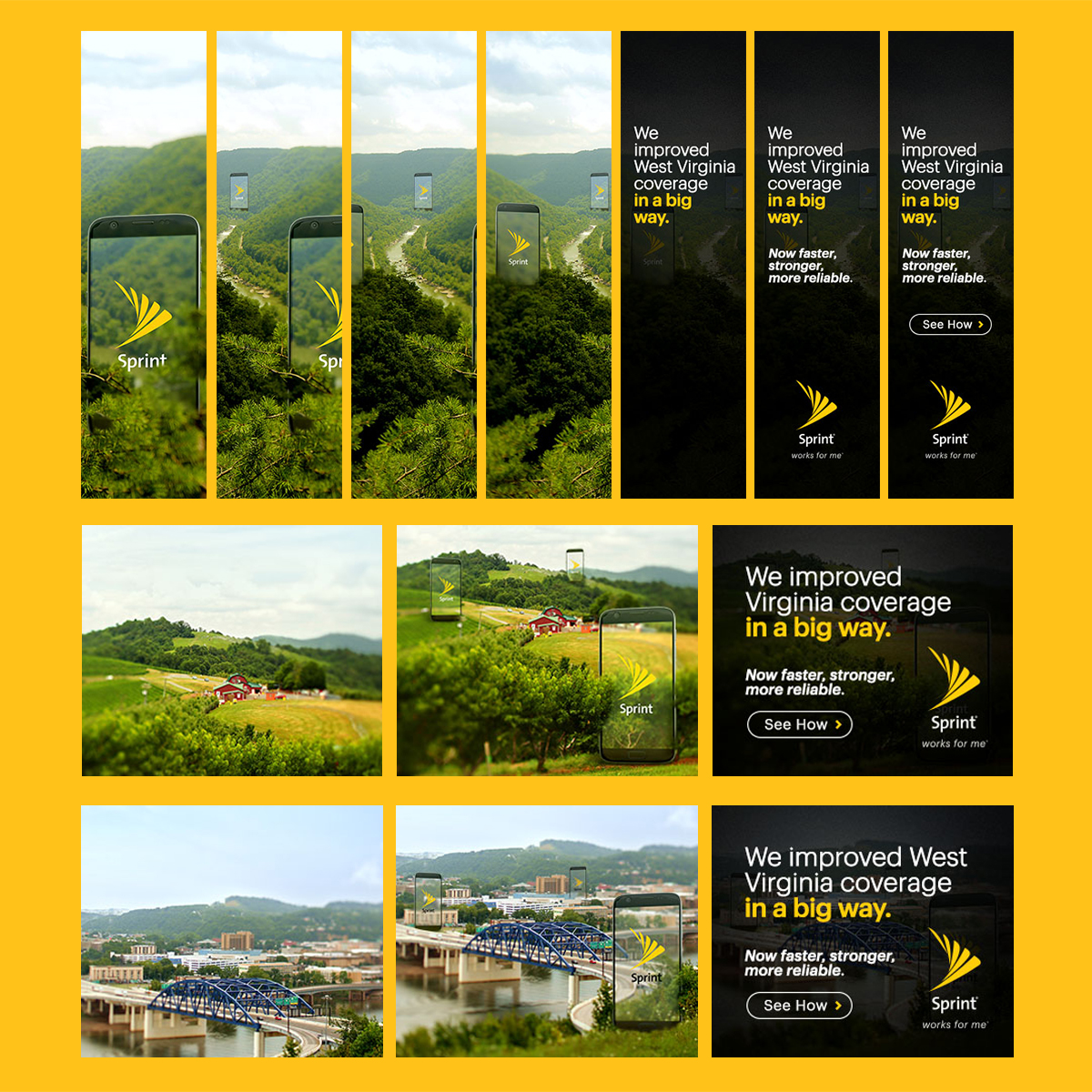

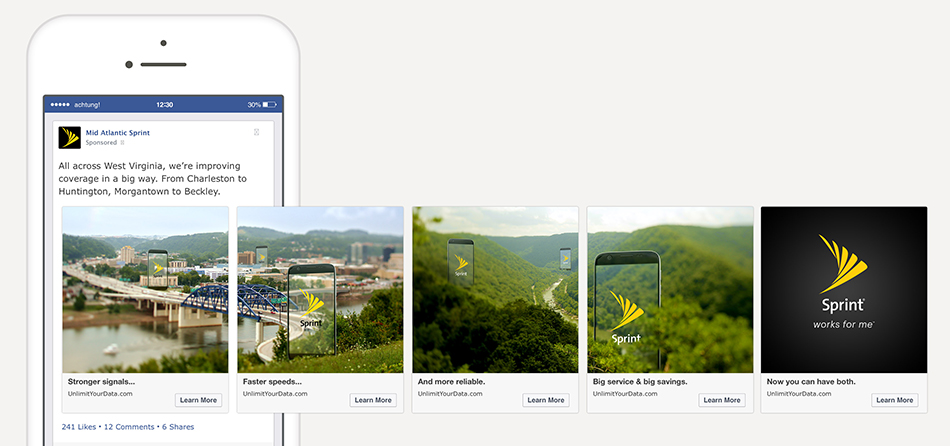

Creative Execution/Production

Each production element was carefully thought through in collaboration with the client to ensure it was on strategy.

For example:

- All video footage and photography used in the campaign was shot authentically in the markets in which the advertising ran.

- The DMAs/cities selected to feature in the communications represented key geographies with the highest percentages of potential switchers determined by the audience segmentation research.

- The “big” phone icon used throughout the campaign was a symbolic nod to Sprint being EVERYWHERE.

- Fast-paced Stop Tilt video cameras were used to represent high speed, high tech and high performance.

- No promotional offers were included in the messaging as it was disingenuous to talk about community investment while hawking a BOGO. Promotional messaging was handled separately.

- GKV used internal production resources to edit and finish the spots, at a tremendous cost savings to the client.

Media Selection and Criteria Used

A multi-media approach was used as follows:

- Television was run to build awareness quickly and to demonstrate the Sprint market investment.

- At launch, local news and cable networks were used to reach influencers

- Subsequently, television was purchased to achieve reach and frequency goals against the broad audience of 25-54 as well as each of the three key demographic segments mentioned before

- Sports programming tied into local college teams (Virginia Tech, UVA, West Virginia, etc.) to tap into local pride

- Radio was used to target locally and primarily designed to reach customers in the car given length of time driving in these less densely populated areas where previously wireless coverage could be spotty.

- Digital advertising was used with a combination of pre-roll and banner ads served specifically via carrier targeting. Verizon, AT&T and T-Mobile customers got separate messages suggesting they switch from their current plan to a Sprint plan.

- Out of home was used to deliver additional frequency and reach to customers traveling across the state.

- Point of sale was used to reinforce messaging at retail with multiple versions created and posted based on the geographic location of the store.

- Grassroots tactics such as yard signs, door hangers, etc.

- Current customers were sent a direct mail execution.

Results

- Over 90% of nTelos customers were successfully migrated to Sprint despite the work-in-progress nature of the network upgrade construction. These customers were free to switch to any carrier and this high retention level far exceeded Sprint expectations.

- Customers ported in (switched) to Sprint from the competition at a much higher rate than customers ported out from Sprint or nTelos to a competitor

- Net Promoter Scores tripled within a year

- Top-of-mind awareness increased by over 25%

- Store traffic increased up to 41%

- Gross adds (acquisition) rose to their highest level in company history

- Churn (retention) remained steady despite the service interruptions during tower upgrades